40+ how much can i be approved for mortgage

While DTI requirements will vary by lender the percentages below are a good rule of thumb. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes.

Mortgage Choice Broker Serving Cary Raleigh And The Triangle

Web The two main factors that are typically considered in determining how much mortgage you qualify for are your monthly income and your monthly expenses.

. The monthly cost of property taxes HOA dues and homeowners insurance. Ad Compare Find the 10 Best Pre Approval Mortgage In US. Get Instantly Matched With Your Ideal Mortgage Lender.

Web For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Web The traditional monthly mortgage payment calculation includes. With a Low Down Payment Option You Could Buy Your Own Home.

Web Your mortgage payment should be 28 or less. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Best Mortgage Pre-Approval in Washington.

Compare Now Find The Lowest Rate. Web While you can qualify for a mortgage with a debt-to-income DTI ratio of up to 50 percent for some loans spending such a large percentage of your income on debt might leave you without enough. Ad Tired of Renting.

Plenty of buyers prefer other options like 10-year 20-year 25-year 40-year and even five-year terms based on their monthly income and budgetary goals. Payments you make for loans or other debt but not living expenses like rent. Terms arent limited to 30 and 15 years.

This is for things like insurance taxes maintenance and repairs. Use our required income calculator above to personalize your unique financial situation. Get a call back.

Also your total monthly debt obligations debt-to-income ratio should be 45 or lower. With a fixed-rate loan your interest rate will never change. With a Low Down Payment Option You Could Buy Your Own Home.

Web Provide details to calculate your affordability. Web You can also connect with a home mortgage consultant and have a conversation about your home financing needs your loan choices and how much you may be able to borrow. Get Your Approval Letter Once youve chosen your mortgage option you can see if youre approved for it.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. The Maximum Mortgage Calculator uses your current financial situation to calculate the maximum monthly mortgage payment that you can afford. Web To decide how much of your income you can reasonably allocate to monthly mortgage payments try the 2836 rule.

But our chase home affordability calculator can help refine and tailor the estimate of how much house you can afford based on additional factors. Estimate your monthly mortgage payment. Were not including any expenses in estimating the income you need for a 250000 home.

Total income before taxes for you and your household members. Best Mortgage Pre-Approval in Washington. If you hold this loan to full term it will take you 480 monthly payments to pay it off.

The mandatory insurance to protect your lenders investment of 80 or more of the homes value. Why Rent When You Could Own. Web The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

You should have three months of housing payments and expenses saved up. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. Web This is where youll see how much we can approve you for as well as recommended types of home loans down payments monthly payments and interest rates.

Apply Easily Save. The primary factors for mortgage approval. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability.

Like other mortgages youll pay this loan off with regular monthly payments that include interest. Web Ideally you want a debt-to-income ratio in the 30-40 range to qualify for a mortgage loan. When youre ready your home mortgage consultant will help you complete an application.

Web As the name suggests a 40-year mortgage is a home loan with a term of 40 years. Find a local consultant. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

The cost of the loan. Web Use our mortgage required income calculator to get an idea of how much mortgage you can afford. Factors that affect your affordability.

Your credit score is above 620 You have a down payment of 3-5 or more Your existing debts are low Youve had a stable job and income for. Ad Find How Much House Can I Afford. Apply Get Pre-Qualified in 3 Min.

That is your mortgage payment shouldnt be more than 28 of your total monthly pre-tax income nor more than 36 of your total debts. For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000. Your housing expenses should be 29 or less.

Web Most home loans require a down payment of at least 3. It is however a good starting point in figuring out if you can get pre-approval for a home loan. This ensures you have enough money for other expenses.

Web While the Consumer Financial Protection Bureau CFPB reports that banks will qualify mortgage amounts that are up to 43 of a borrowers monthly income you might not want to take on that much debt. Ad Compare Find the 10 Best Pre Approval Mortgage In US. Ad See how much house you can afford.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Your debt-to-income ratio DTI should be 36 or less. Apply Easily Save.

The amount of money you borrowed. Web Youll have the best chances at mortgage approval if. Apply Get Pre-Qualified in 3 Min.

Web Todays mortgage rates.

How Much Mortgage Can I Qualify For Viisi Expats

How Much Mortgage Can I Qualify For

Used Mobile Home Dealers In Alabama

Become A Mortgage Loan Originator 6 Step Guide

Can I Get A 40 Year Mortgage Unbiased Co Uk

Mortgage Prequalification Calculator How Much Can You Borrow Moneyunder30

The Cost Of Quality Themreport Com

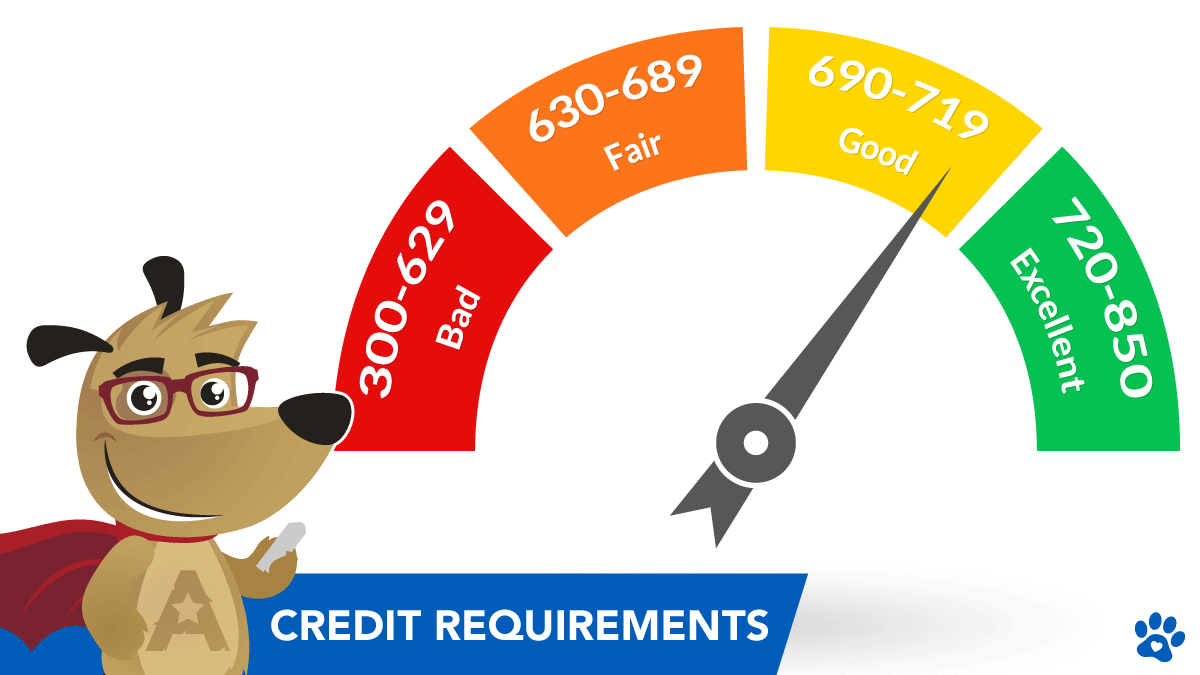

Credit Requirements For A Reverse Mortgage In 2023

Read This Before Buying Your First Home Retire By 40

How Much A 250 000 Mortgage Will Cost You Credible

Trudy Moore Loan Originator Mutual Of Omaha Mortgage Linkedin

Rossi Riina Real Estate Rrvermont Com

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

Thoughtskoto

Development Of 40 Affordable Single Family Homes Approved In Holland

How Long Does A Mortgage Pre Approval Last Texas United Mortgage

How Much Can I Borrow For A Mortgage